Rupay cards,

rupay cards :

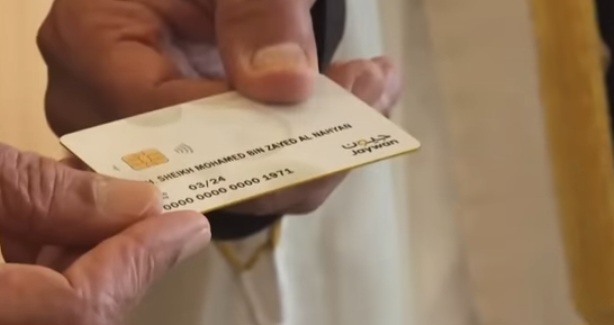

Yes, RuPay cards can be used in the United Arab Emirates (UAE). The National Payments Corporation of India (NPCI) has expanded the acceptance network of RuPay cards globally, including in the UAE. Users can use their RuPay cards for various transactions such as making purchases at merchants, online shopping, and withdrawing cash from ATMs in the UAE, just like they would in India. This expansion of RuPay’s acceptance network demonstrates its growing presence as an international payment network.

facilitates smoother financial transactions but also fosters cultural and economic exchange between India and the UAE. As the partnership between NPCI and UAE-based financial institutions continues to evolve, it is anticipated that RuPay will play a pivotal role in shaping the future of digital payments in the region, demonstrating that innovative solutions need not always rely on artificial intelligence to deliver value and convenience to users.

hasn’t been any official announcement regarding Prime Minister Narendra Modi and Sheikh Mohammed bin Zayed Al Nahyan (MBZ), the Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, jointly launching the RuPay card. However, it’s worth noting that both leaders have been involved in initiatives to strengthen bilateral relations between India and the UAE, and the expansion of RuPay’s acceptance network to the UAE could certainly be a part of such efforts. If there have been any developments

Moreover, the expansion of RuPay’s acceptance network to countries like the United Arab Emirates (UAE) further enhances its role in facilitating economic exchange and strengthening bilateral relations. As RuPay cards gain acceptance globally, they serve as a symbol of India’s growing influence in the international financial landscape.

The global expansion of RuPay’s card:

CardsStrategic Partnerships:

NPCI’s concerted efforts to expand the acceptance network of RuPay cards have yielded significant results, with partnerships forged across international borders. The acceptance of RuPay cards in the UAE underscores the growing recognition of India’s financial prowess on the global stage.

Everyone’s Invited: RuPay cards are all about making financial services accessible to everyone, regardless of their background or income level. They’re affordable, widely accepted, and easy to use, making them a game-changer for those who might otherwise be left out.Opening Doors: With RuPay cards, people can do more than just pay for things. They can participate in the digital economy, shop online, and access cash when they need it.

Bilateral Relations:

The launch of RuPay cards in the UAE signifies more than just an expansion of payment options; it symbolizes the strengthening of bilateral relations between India and the UAE. As economic ties deepen, RuPay cards serve as ambassadors of India’s technological innovation and economic growtechnology, traditional payment methods continue to hold significance, particularly in fostering financial inclusivity. The RuPay card, pioneered by the National Payments Corporation of India (NPCI), exemplifies this ethos, providing accessible and reliable payment solutions without the reliance on artificial intelligence (AI) features. This article delves into the importance of RuPay cards in promoting financial inclusivity, their technological underpinnings, and their expanding presence in international markets, notably in the United Arab Emirates (UAE).

Acceptance and adoption

The acceptance of RuPay cards in the UAE opens new avenues for economic exchange and collaboration between India and the Gulf region. Residents and visitors in the UAE benefit from competitive exchange rates, enhanced security features, and accessibility to a wider range of financial services.Cultural

Significance:

Beyond its economic implications, the acceptance of RuPay cards in the UAE carries cultural significance, fostering greater understanding and connectivity between the two nations. As India’s influence permeates global markets, RuPay cards serve as ambassadors of its rich heritage and technological prowess.

ConclusionIn conclusion,

RuPay cards epitomize the convergence of tradition and innovation in the realm of financial technology. As champions of financial inclusivity, they empower individuals with accessible and reliable payment solutions, transcending geographical boundaries. The expansion of RuPay cards to international markets like the UAE signifies India’s ascent as a global economic powerhouse, driven by principles of accessibility, affordability, and technological innovation.This comprehensive exploration underscores the significance of RuPay cards in shaping the future of financial transactions, both domestically andtechnological innovation.This comprehensive exploration underscores the significance of RuPay cards in shaping the future of financial transactions, both domestically and internationally, while reaffirming their pivotal role in fostering financial inclusivity and advancing economic prosperity.